how to lower property taxes in ohio

Here are a few tips that may help. In Cuyahoga County for example.

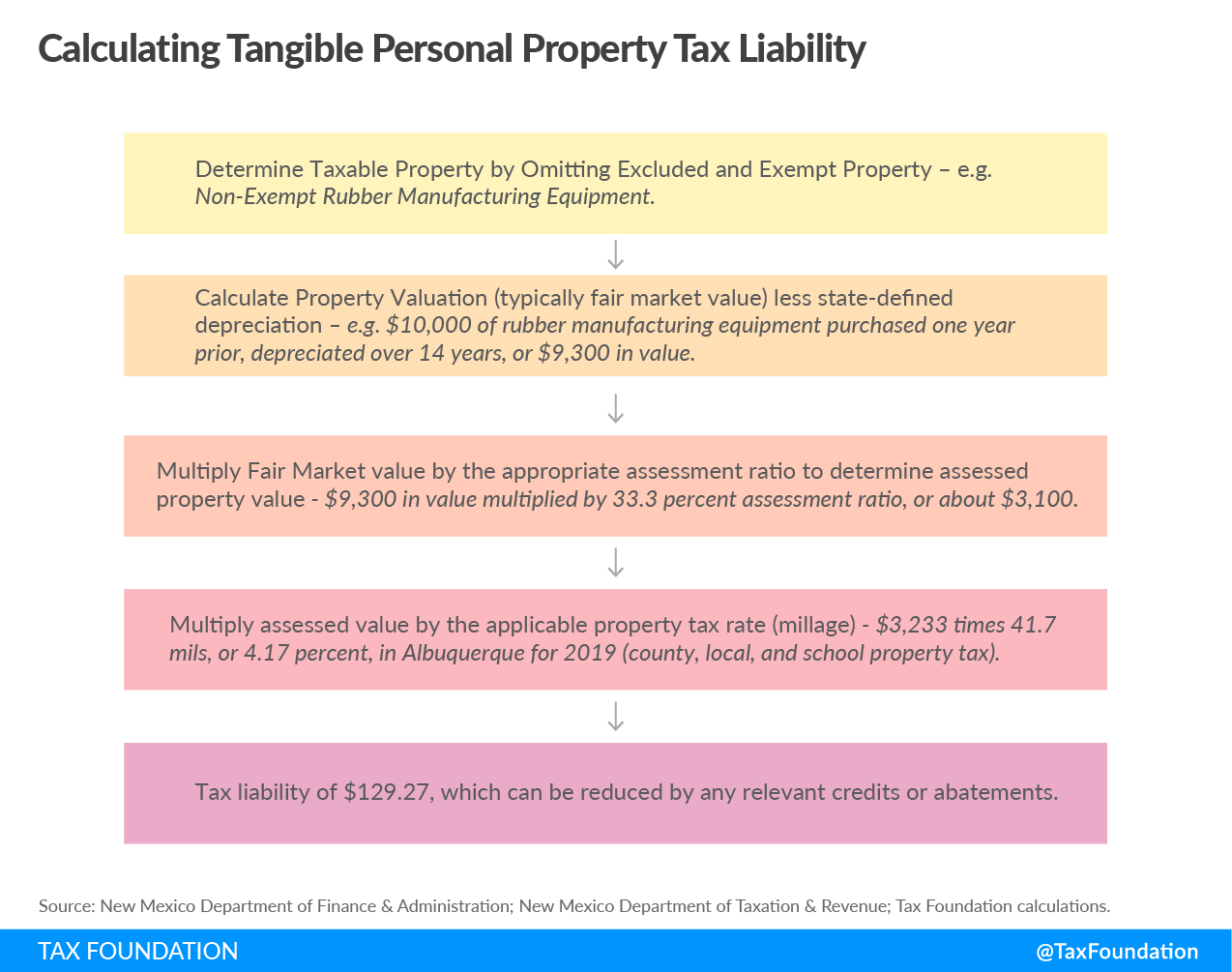

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Hiogov 105 Tax reduction factors.

. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you. Ohio Property Tax ExemptionFrom A to Z. The Ohio Department of Taxation maintains detailed statistics on property values and tax rates at the county city and school district level.

Lower Rates In Some Counties. In order to come up with your tax bill your tax office multiplies the tax rate by the. We always look back in time.

Come cannot exceed the amount set by law. Ask for the property tax. Between 20 and 40 of homeowners in Ohio who.

The biggest step you can take though is to launch an appeal to have your assessment reappraisedand hopefully reduced. Property taxes are high in Ohio but there are several counties that have lower rates. With a property tax rate of 148 Ohio holds 13th place among states with the highest property tax rates.

Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is definedas modifiedadjusted gross. Property Tax Real Property. Yet last year only about 4000 appeals were filed to contest property.

The average Ohio property tax rate is 157. Under Ohio law each county must. Lets say that Mike and Wendy appeal the 200000 taxable value of their home.

Once the complaint is received the BOR will take two actions. If youre a homeowner in Ohio you may be looking for ways to lower your property taxes. The DTE Form 1 Complaint Against the Valuation of Real Property gives the Board of Revision the complaining partys opinion of a property s estimated value for the year the tax.

Ohio Property Tax Rates. Located in central ohio stark county has property taxes far lower than most of ohios other urban counties. CLEVELAND Ohio - There are more than 500000 parcels in Cuyahoga County.

How To Lower Property Taxes In Ohio. How can I lower my property taxes in Ohio. Your local tax collectors office sends you your property tax bill which is based on this assessment.

Property tax rates in Ohio are expressed as millage rates. How to Appeal PropertyTaxes in Ohio. Ohio Property Tax Rates.

One mill is equal to 1 of tax for every 1000 in assessed value. Located in central Ohio Stark county. In Ohio property owners pay taxes for periods of time that have already passed so you may hear that owners are paying taxes one year in arrears.

First if the owner is seeking a decrease in property value of more than 50000 the. Original data sets reported via abstracts to the. Then in 2007 the General Assembly.

Up to 25 cash back If they can reduce the taxable value of their home their property tax bill will be lower. If you own a property in Ohio and this. Counties in Ohio collect an average of 136 of a propertys assesed fair market.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. Ohios Property Taxes. In 1970 Ohio voters approved a constitutional amendment permitting a homestead exemption that reduced property tax for lower income senior citizens.

As detailed by the ohio department of taxation the homestead. Each year the department calculates effective tax rates based on tax reduction factors that eliminate the effect of a.

Yet Another Source Of Inequality Property Taxes Federal Reserve Bank Of Minneapolis

U S Cities With The Highest Property Taxes

2022 Property Taxes By State Report Propertyshark

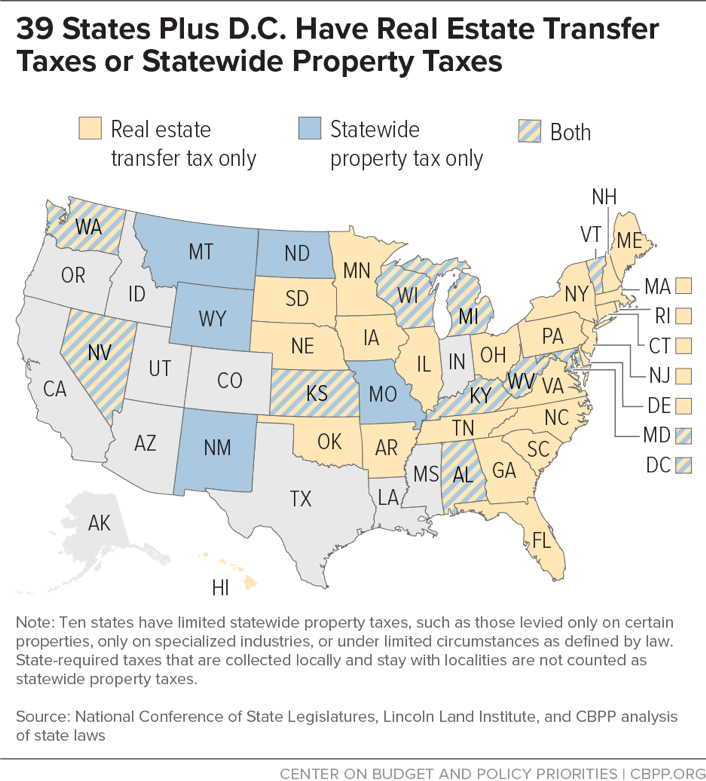

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

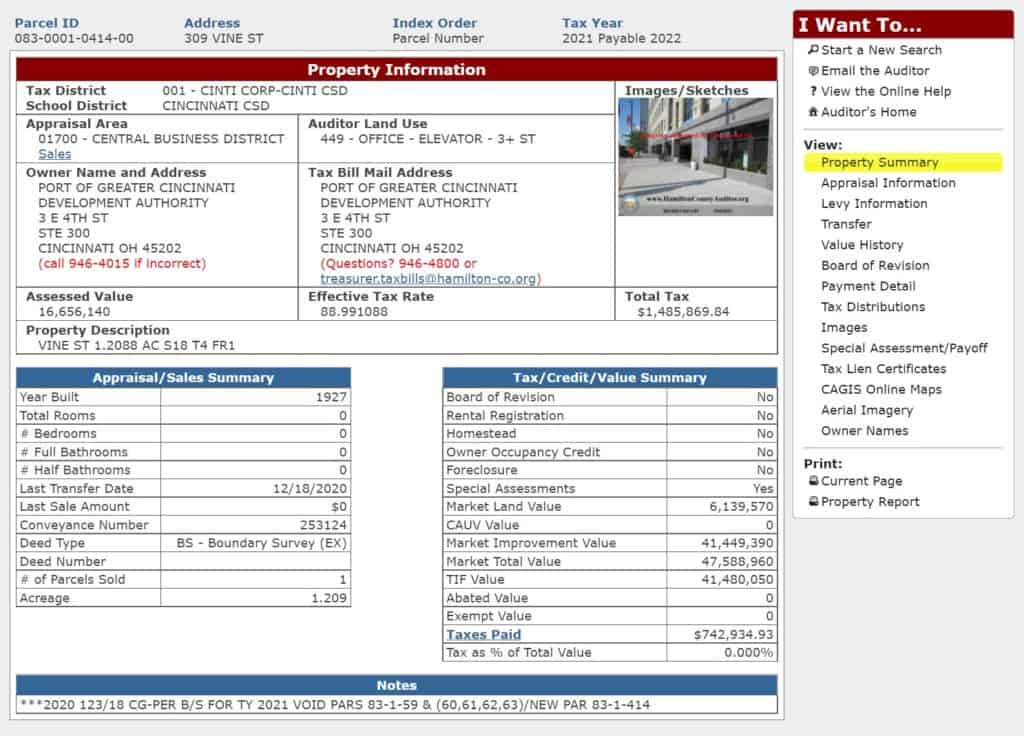

Hamilton County Ohio Property Tax 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

What To Do When You Can T Pay Your Property Taxes Next Avenue

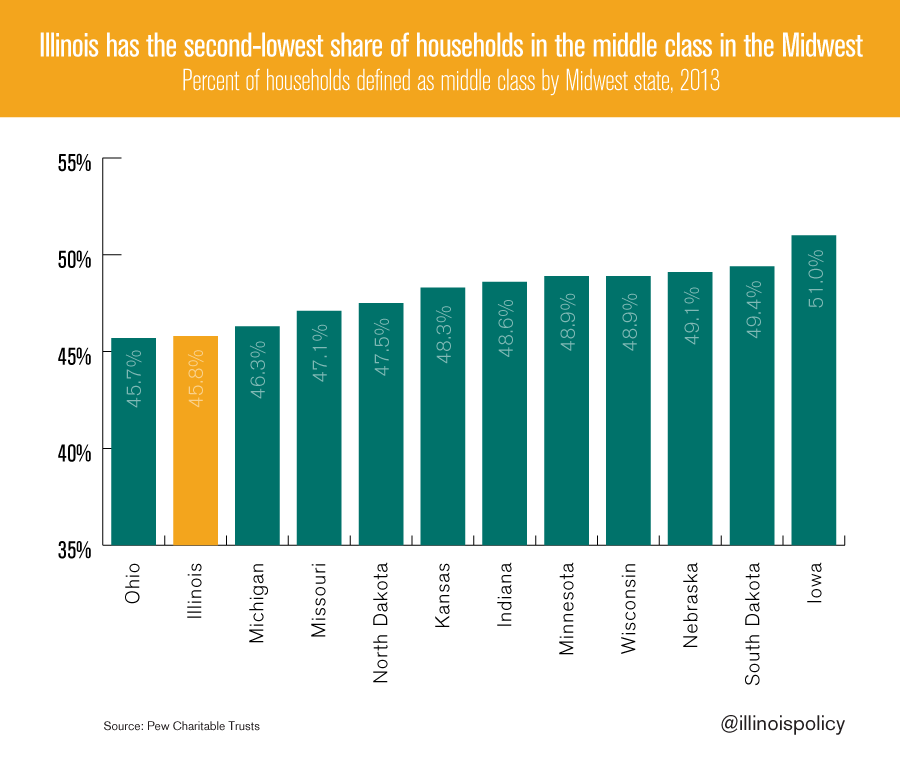

Illinois Middle Class Shrinking As Property Taxes Shoot To Record Levels

Ohio Property Tax Calculator Smartasset

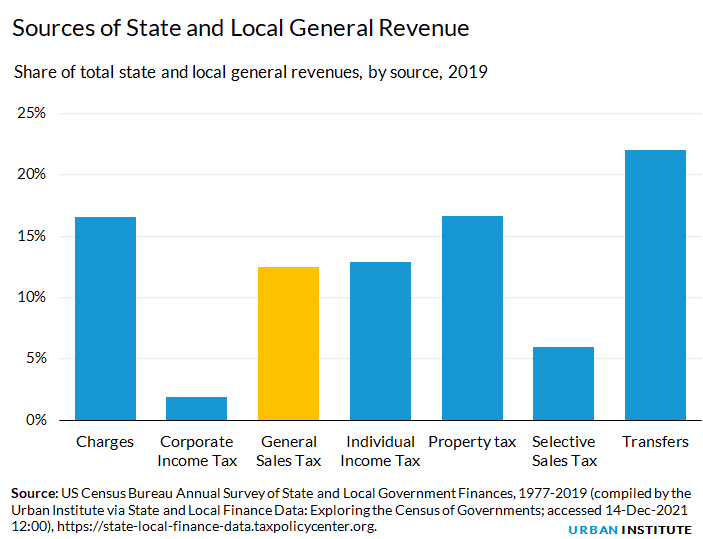

General Sales Taxes And Gross Receipts Taxes Urban Institute

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

How To Lower Property Taxes 7 Tips Quicken Loans

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

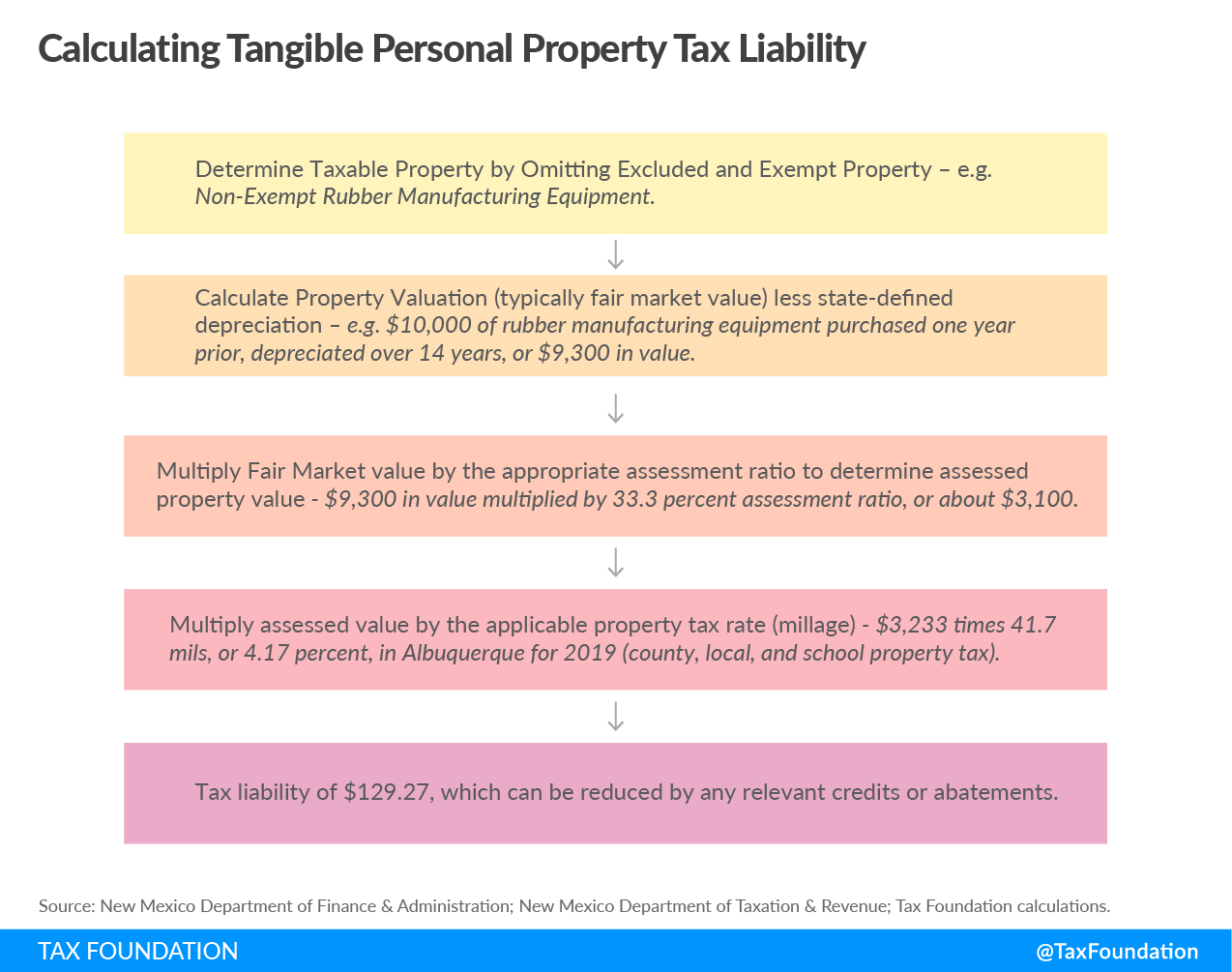

Tangible Personal Property State Tangible Personal Property Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide